In an industry built on service, precision, and paperwork, insurance agencies need systems that run like clockwork.

But between handling carrier downloads, processing renewals, and managing client questions, your team can only stretch so far. That’s where remote teams shine.

Whether you’re a two-person brokerage or a growing agency, going remote with the right support gives you the edge, faster service, lower overhead, and round-the-clock coverage.

Here’s exactly why remote teams are winning in the insurance world—and how your agency can benefit next.

The Traditional Model Is Holding Agencies Back

For decades, the “safe” way to build an insurance agency was to hire in-house. But today, that comes with real pain points:

- Costly salaries and office overhead

- Slow hiring and high turnover

- Limited service hours (especially across time zones)

- Burnout from admin overload

- Bottlenecks in document processing and follow-up

In today’s competitive, client-first environment, this model simply can’t keep up.

Why Remote Teams Are a Smarter Fit for Modern Insurance

Let’s break down the core reasons remote teams, especially virtual assistants—are now the top choice for efficient agencies.

1. Around-the-Clock Responsiveness

Clients expect fast service. Carriers expect clean paperwork. With a remote team, you can:

- Extend your service hours beyond 9–5

- Have someone available during lunch, after-hours, or holidays

- Respond to client inquiries before they become complaints

2. Significant Cost Savings

Hiring in-house CSRs or account managers can cost $50K+ per year, not including benefits, equipment, or space.

Remote team members (like insurance-trained VAs) deliver the same work for a fraction of the cost—often under $1,100/month for full-time help. That’s 60–75% cost savings with zero payroll taxes, office rent, or hiring headaches.

3. Less Turnover, More Consistency

The insurance industry sees frequent turnover in entry-level admin roles. Remote teams, especially outsourced virtual assistants, offer:

- Lower turnover

- Better documentation and systems

- Long-term support that doesn’t vanish when someone quits

You don’t lose momentum every time someone leaves.

4. Instant Specialization

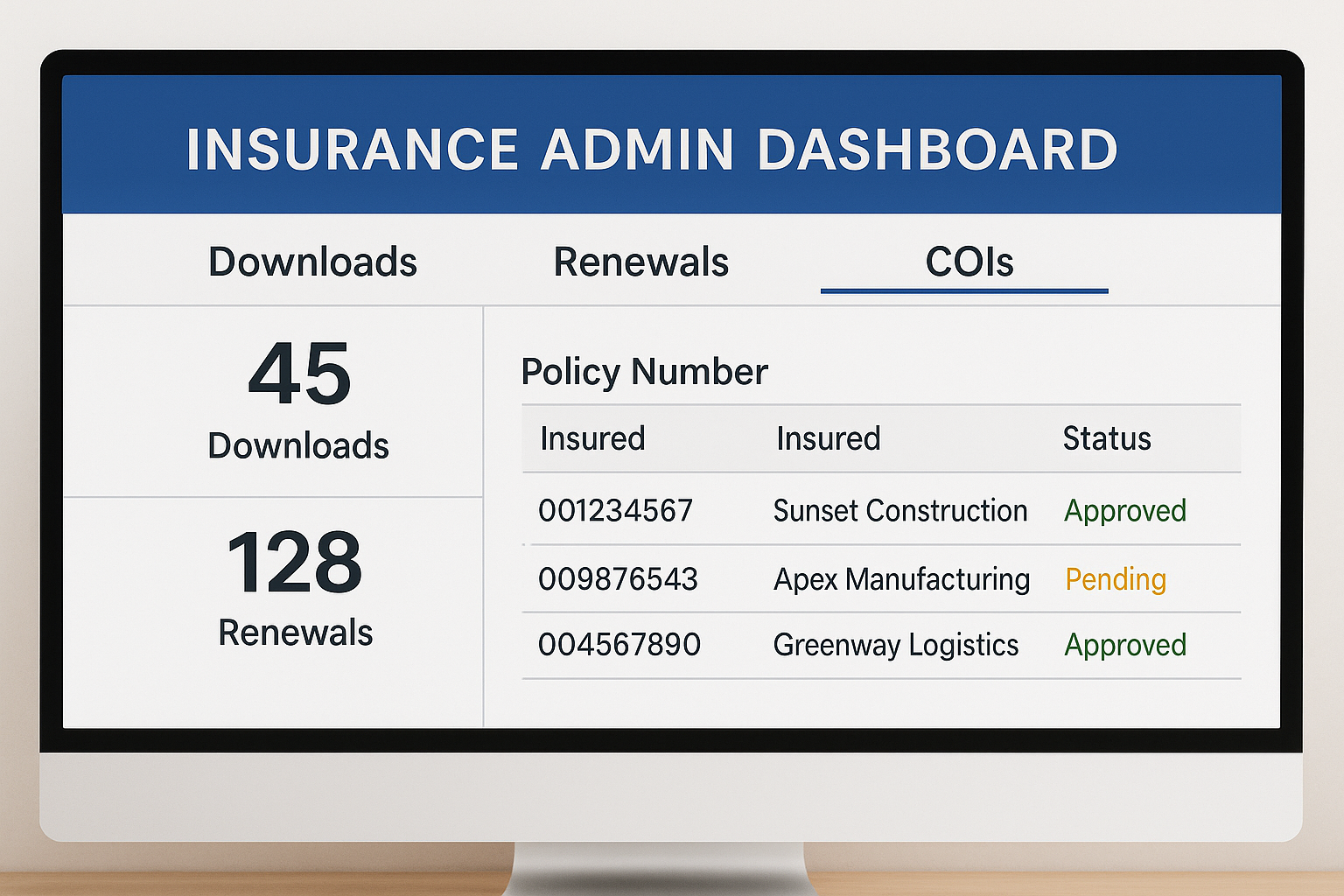

Need someone to process endorsements? Handle COIs? Track renewals? Clean up carrier downloads?

Remote assistants trained in insurance workflows can start handling specific tasks day one—no 6-week training programs required.

You get plug-and-play support that fits your exact needs.

5. Focused Producers = More Sales

When your licensed producers are buried in admin work, they’re not selling. Remote team support removes that roadblock so they can:

- Spend more time building relationships

- Close more renewals and new policies

- Reduce mental clutter and burnout

Your team works smarter, not harder.

6. Clients Don’t Know (or Care) Where Your Team Is

As long as they get:

- Quick responses

- Clean documentation

- Reliable follow-through

…your clients don’t care if that support came from your back room or a remote assistant three states away.

In fact, they’ll often get better, faster service than they would from a local-only team.

What Remote Team Members Can Handle for Your Insurance Agency

Here are just a few things remote insurance VAs do daily:

- Manage and clean up carrier downloads

- Process endorsements and cancellations

- Track renewals and send reminders

- Handle COI requests

- Answer inbound client emails

- Route urgent calls to your team

- Prepare policy documents and invoices

- Keep CRMs and AMS platforms up to date

When to Start Building Your Remote Insurance Team

You’re ready if:

- Your producers are spending 30%+ of their time on admin

- You’re missing deadlines or slow to respond to client service needs

- Your in-house staff is overwhelmed

- You want to grow without increasing office headcount

- You’re tired of paying $50K/year for help that burns out in 6 months

Start with one trained VA. Then scale support as your book grows.

Remote Isn’t the Future. It’s the Present.

The insurance agencies that scale fastest, serve better, and protect margins aren’t the ones adding more desks. They’re the ones adding smarter systems and remote support.

You don’t need a bigger team. You need a better one, with the flexibility and focus to move fast and serve well.