The Hidden Costs Draining Your Insurance Brokerage Profits

Are you still paying $50,000+ annually for in-house Customer Service Representatives? If so, you’re likely overlooking a significant opportunity to improve your brokerage’s profitability. When you factor in benefits, training costs, office space, equipment, and turnover expenses, that $50K salary quickly balloons to $65,000-$75,000 annually—a substantial financial burden for independent insurance agencies operating on tight margins.

Today’s insurance landscape demands operational efficiency more than ever before. With compressed commissions, increasing carrier requirements, and rising client service expectations, the traditional staffing model is becoming financially unsustainable for many brokerages. Yet quality client service remains non-negotiable in an industry built on relationships and trust.

There’s a smarter solution: remote CSRs. This approach isn’t just about cost-cutting—it’s about strategic resource allocation that can transform your brokerage’s financial performance while maintaining or even enhancing service quality.

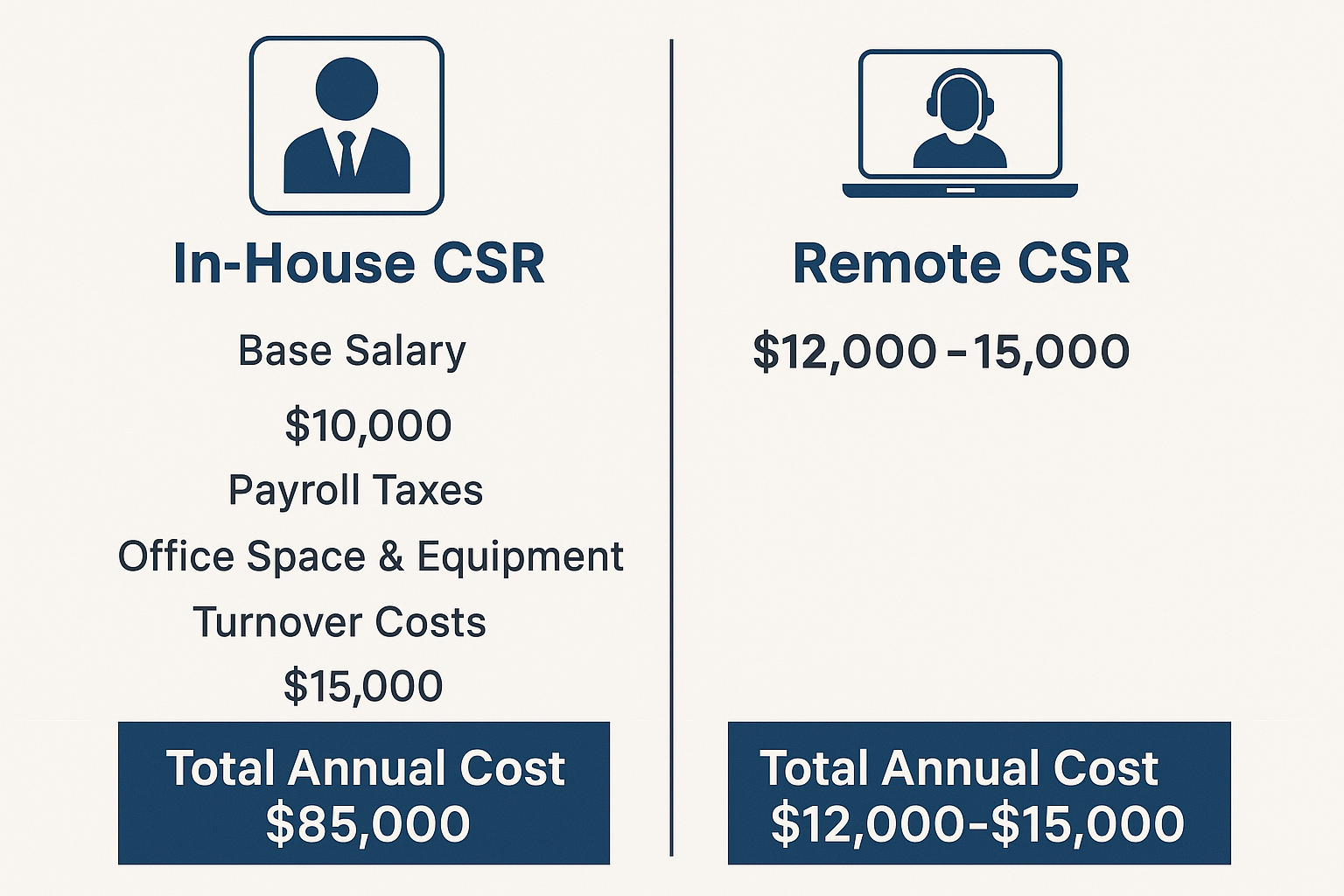

The True Cost Comparison: In-House vs. Remote CSRs

Before diving into the benefits, let’s examine the stark financial reality of traditional CSR staffing compared to the remote alternative:

Traditional In-House CSR ($65,000+ Total Annual Cost)

- Base Salary: $45,000-$55,000

- Benefits (health insurance, retirement, etc.): $10,000-$15,000

- Payroll Taxes: $3,500-$4,500

- Office Space & Equipment: $4,000-$7,000

- Training & Onboarding: $2,500-$5,000

- Management Overhead: $5,000+

- Turnover Costs (avg. 30% turnover rate): $15,000 amortized annually

Remote CSR ($32,000-$48,000 Total Annual Cost)

- Service Fee: $32,000-$48,000 (based on experience level and hours)

- No additional costs for benefits, office space, equipment, or turnover

- No management overhead or payroll tax burdens

- Training costs included in service fee

- 40-50% cost reduction compared to in-house staff

7 Financial Advantages of Switching to Remote CSRs

Remote CSRs offer numerous financial benefits beyond the obvious salary savings:

1. Elimination of Hidden Employment Costs

The salary is just the beginning of what you pay for in-house staff. Remote CSRs eliminate expenses for health insurance, retirement contributions, workers’ compensation, unemployment insurance, and other benefits that typically add 20-30% to base salary costs.

Real Example: A 5-person agency in Colorado reduced their total staffing costs by $84,000 annually by replacing two in-house CSRs with remote support, eliminating $32,000 in annual benefit expenses alone.

2. Flexible Scaling Without Financial Commitment

Remote CSR services allow you to scale support hours up or down based on seasonal needs or growth patterns without the financial obligation of full-time salaries during slower periods.

Real Example: A Florida-based brokerage saves approximately $22,000 annually by scaling their remote CSR support down during summer months when their snowbird clients require less attention.

3. Elimination of Productivity Gaps During Transitions

When in-house staff resign, productivity suffers during the vacancy and training periods. Remote CSR providers ensure continuous service even when individual CSRs change, eliminating costly transition gaps.

Real Example: One agency calculated they lost approximately $27,000 in productivity and new business opportunities during a 6-week CSR position vacancy—a cost they haven’t experienced since switching to remote support.

4. Reduced Management Overhead

In-house CSRs require supervision, performance reviews, and HR management—all consuming valuable producer or agency principal time. Remote CSRs come with built-in management and quality control.

Real Example: An agency principal recovered 7 hours weekly previously spent on CSR management after switching to remote support, generating an additional $105,000 in annual revenue through increased sales activities.

5. Overhead Cost Elimination

Each in-house employee requires physical space, equipment, software licenses, utilities, and other overhead expenses that disappear with remote support.

Real Example: By eliminating the need for additional office space to accommodate growing staff, one brokerage avoided a $1,700 monthly lease increase, saving over $20,000 annually.

6. Training Investment Protection

When you invest in training an in-house CSR who then leaves, that investment walks out the door. Remote CSR providers absorb training costs and maintain knowledge continuity regardless of individual staffing changes.

Real Example: A Texas-based agency calculated they lost over $12,000 in training investments when two consecutive CSRs left within 18 months after receiving extensive carrier and system training.

7. Turnover Cost Elimination

The cost of replacing an employee typically ranges from 30-150% of their annual salary when accounting for recruiting, hiring, training, and productivity losses. Remote CSRs eliminate these turnover costs entirely.

Real Example: One agency with historically high CSR turnover estimated savings of $35,000 annually just in elimination of recruiting, hiring, and onboarding expenses after switching to remote support.

Beyond Cost Savings: The Quality Advantage of Remote CSRs

While financial benefits are compelling, the most successful brokerages find that remote CSRs offer quality advantages as well:

Specialized Insurance Expertise

Top remote CSR providers offer staff with extensive insurance experience, often exceeding what’s available in local talent pools, especially for brokerages in non-metropolitan areas.

Consistent Service Standards

Professional remote CSR services implement standardized processes and quality control measures that ensure consistent client experiences, regardless of which team member handles the task.

Extended Availability

Many remote CSR providers offer extended hours coverage beyond the typical 9-5 workday, enhancing client service without overtime expenses.

Focus on Performance Metrics

Remote CSR services typically track detailed performance metrics, providing accountability and data-driven service improvements that are often lacking with in-house staff.

Case Study: Financial Transformation Through Remote CSR Implementation

Agency: Mountain West Insurance Partners, a 3-producer P&C agency with $1.2M in annual revenue

Challenge: Two in-house CSRs with combined costs of $135,000 annually (including benefits and overhead). High turnover created additional expenses and service inconsistency.

Solution: Implemented full-time remote CSR support from Citrus Assistants at a total annual cost of $64,000.

Financial Results After 12 Months:

- Annual direct savings: $71,000

- Additional revenue from increased producer capacity: $165,000

- Improved retention from better service consistency: $47,000

- Total financial improvement: $283,000

- ROI: 442%

Common Financial Objections to Remote CSRs—Addressed

Despite the clear financial benefits, some brokerages hesitate to make the switch. Let’s address the common financial concerns:

“What about the transition costs?”

While there may be minor short-term costs during transition, most brokerages achieve positive ROI within 60 days. Additionally, many remote CSR providers offer implementation assistance to minimize disruption.

“Will service quality suffer, leading to client losses?”

Quality remote CSR providers typically improve service metrics, not diminish them. One study found that brokerages using remote CSRs experienced a 7% improvement in retention rates on average, translating to significant financial gains.

“We’ll lose the personal touch with clients.”

Modern remote CSR solutions include phone integration, video conferencing, and personalized service approaches that maintain the relationship element clients value. Most clients can’t tell whether the CSR is in-office or remote.

“We have complex processes that require specialized knowledge.”

Professional remote CSR services have experience with agency management systems, carrier portals, and insurance-specific workflows. The best providers can match or exceed the specialized knowledge of in-house staff at a fraction of the cost.

How to Determine Your Potential ROI from Remote CSRs

To calculate your specific potential savings and ROI, follow this simple formula:

- Calculate your full in-house CSR costs:

- Annual salary

- Benefits costs (typically 20-30% of salary)

- Payroll taxes (approximately 7.65% of salary)

- Office space allocation ($300-500/month per person)

- Equipment and software licenses

- Management time value

- Historical turnover costs

- Compare to annual remote CSR investment for equivalent support hours

- Add potential revenue increases from:

- Improved producer capacity

- Better retention through consistent service

- Extended service hours capability

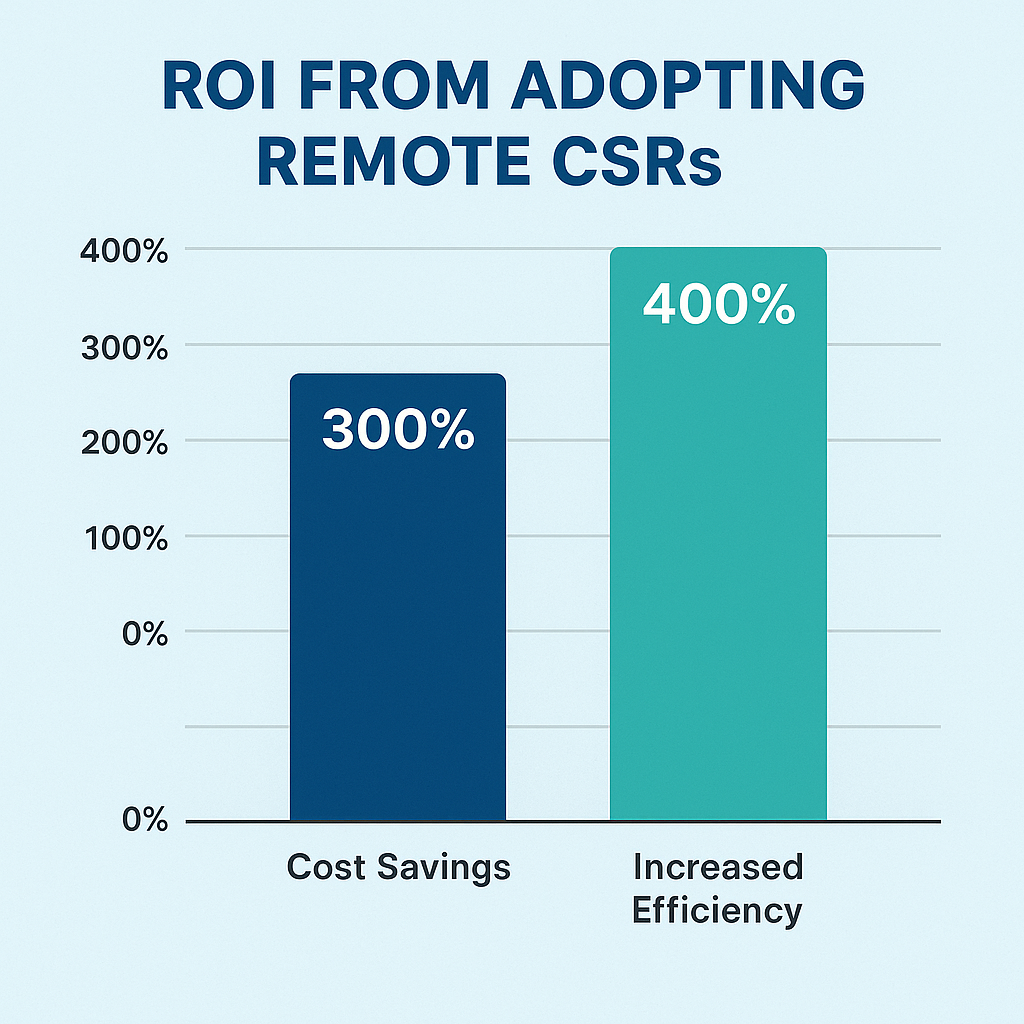

Most brokerages find that remote CSRs deliver 150-400% ROI when all factors are considered.

5 Steps to Transition to Remote CSRs Without Financial Disruption

Making the switch to remote CSRs can be done with minimal financial disruption by following these steps:

1. Conduct a Thorough Cost Analysis

Document all current CSR-related expenses to establish your true baseline cost and identify potential savings.

2. Start with Hybrid Implementation

Consider starting with remote CSRs handling specific functions (certificates, policy checking, etc.) while maintaining some in-house staff during transition to minimize disruption.

3. Establish Clear Metrics for Success

Define key performance indicators to measure the financial and service impact of your remote CSR implementation.

4. Invest in Proper System Access and Documentation

Ensure remote CSRs have appropriate system access and documented procedures to maintain service continuity during transition.

5. Communicate the Strategy to Stakeholders

Help your team and clients understand the benefits of the new approach to ensure smooth adoption and acceptance.

Conclusion: The Financial Future of Insurance Brokerage Staffing

The insurance brokerages achieving the strongest financial results today are those embracing operational innovation, including remote staffing models. With potential cost reductions of 40-50% while maintaining or improving service quality, remote CSRs represent one of the most significant financial optimization opportunities available to independent agencies.

As commission compression continues and operational costs rise, the financial advantage will increasingly belong to brokerages that leverage remote support solutions to control expenses while maximizing producer capacity and client service quality.

The question is no longer whether remote CSRs make financial sense—it’s whether your brokerage can afford to continue with the traditional staffing model in an increasingly competitive landscape.

Ready to transform your brokerage’s financial performance through remote CSR implementation? Contact Citrus Assistants today for a personalized cost analysis and discover how much your agency could save while improving service quality.

FAQ: Financial Aspects of Remote CSRs

How quickly will we see ROI from switching to remote CSRs?

Most brokerages see positive cash flow within the first 60 days of implementation. Complete ROI, including transition costs, typically occurs within 3-4 months. When factoring in improved retention and increased producer capacity, the financial benefits accelerate significantly after the initial implementation period.

Are there hidden costs with remote CSRs we should consider?

Professional remote CSR services include all costs in their service fee, eliminating the hidden expenses of traditional employment. Some brokerages may need minor technology adjustments for optimal remote access, but these are typically one-time costs far outweighed by ongoing savings.

How do remote CSRs affect our E&O exposure and associated costs?

Quality remote CSR providers typically have excellent error rates due to standardized processes and quality control measures. Many brokerages report fewer E&O concerns after implementation, potentially reducing insurance costs. Additionally, comprehensive documentation by remote CSRs often improves defense capabilities if claims arise.

Can we customize service hours to optimize our spending?

Yes, unlike salaried employees who are paid regardless of workflow, remote CSR services can be structured to align with your actual needs. Many brokerages optimize costs by adjusting service hours seasonally or allocating more support during high-volume periods like renewal seasons.

What’s the financial impact if our agency management system requires licensing fees for remote users?

Most professional remote CSR services include system access costs in their service fees. If additional licenses are required, the cost is typically minimal compared to the overall savings. Some providers can even work within your existing license structure using secure access methods.

Ready to calculate your specific potential savings from implementing remote CSRs? Contact our financial analysis team for a personalized assessment based on your brokerage’s unique needs and structure.